We were quite bullish on gold as a new trading week began yesterday, but is there perhaps more to it than merely bullish charts would have us infer? Here’s the message that went out the night before to Rick’s Picks subscribers who may have been disappointed by gold’s quiet finish last week: “Anyone who thinks gold is about to stall out without taking on $1000 should read today’s tout for Comex April. Although the futures have hesitated within 1.70 of our longstanding target [a hula number!] at 952.30, the shallow pullback so far suggests the pivot will not prove to be a serious impediment.” When the dust had settled yesterday, 952.30 proved to have been no serious obstacle at all. In fact, April Gold shot up $28 to $971, and the futures were giving up almost none of the gain as the evening session got under way.

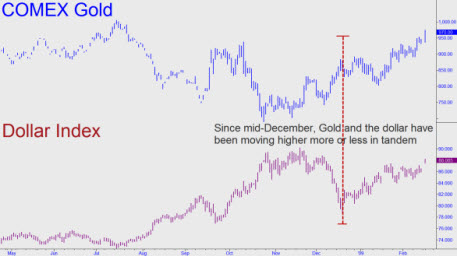

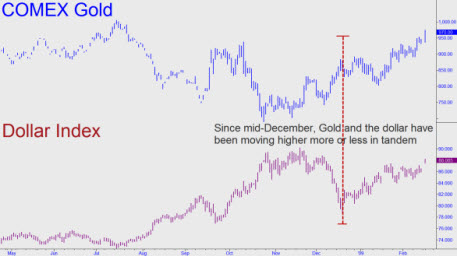

The charts now say that 995.00 should be easily achievable over the very near-term, but we wonder if we’re not being too conservative, considering how spooked the currency markets have been acting. No one who trades gold could have missed the fact that bullion’s sharp rise yesterday came with the Dollar Index also in a steep ascent. This should be disquieting to market observers, but also to gold bugs. While the latter may have reaped substantial trading gains on the move, it suggests that all is not right with the world, to put it mildly.

link

No comments:

Post a Comment